Introducing the Levana Governance Token LVN

IMPORTANT: We couldn't be more excited to be finally sharing this with you. That being said, please keep in mind that this is still very much a work in progress. Much of what we have written here may still be subject to change for various economic or regulatory reasons. While we will always make an effort to provide advance notice of any such changes, this may not be feasible. In any event, nothing we write here should ever be understood as financial or legal advice.

The world of decentralized finance is witnessing rapid innovation, with platforms like the Levana Decentralized Perpetual Swap Exchange emerging as a force to be reckoned with.

Central to Levana's ecosystem is the LVN token, a versatile governance and utility token that offers users the ability to influence the platform's development and benefit from its growth. In this comprehensive guide, we will delve into the usage, distribution, and advantages of the LVN token. We will explore its role in the Levana DAO, its impact on fees and premium membership, interaction with Levana NFTs, and how it is distributed through various mechanisms like lockdrops, emissions, and airdrops. Whether you're a seasoned trader or a newcomer to the world of decentralized finance, this article aims to provide you with a clear understanding of the LVN token's potential and the opportunities it presents for users within the Levana ecosystem.

What is Levana Perps

The decentralized finance (DeFi) ecosystem is continually evolving, with the Levana Perps platform emerging as a groundbreaking decentralized perpetual swap exchange. Built on the Osmosis blockchain, Levana Perps focuses on security, fee reduction, and crypto-backed leverage trading while promoting community governance and cross-chain compatibility. This article will explore the unique aspects of the Levana Perps platform, how it differs from existing perpetual swap platforms, and how it tackles the challenges faced by these platforms in today's DeFi landscape. You can read more about Levana Perps features in our blogpost here.

Why Perpetual Swaps Matter

Perpetual swaps are essential financial tools for a growing DeFi ecosystem, offering two crucial features not available in the spot market: shorting and leverage. These tools allow traders to profit from bear markets, hedge exposed positions, and optimize their trading strategies even with limited capital. Read more about the importance of derivatives and leverage trading here.

The Levana Well-Funded Perps Model

Levana Perps aims to become the most widely used decentralized perpetual trading platform across the crypto space. To achieve this, the platform has introduced the Levana Well-Funded Perps Model, designed to address the issues faced by current perpetual swap applications. These issues include insolvency, reliance on stablecoins, capital inefficiency, contagion risks, cascading liquidations, and inflexible fees. Read more about the system in our whitepaper here.

Key Goals of Levana Perps

-

Build a perpetual swap platform that works to minimize trader and LP risk of insolvency.

-

Cannot become insolvent: Levana Perps ensures that the exchange always has sufficient TVL (total value locked) to cover its payout commitments, preventing insolvency and protecting user funds.

-

Create a perpetual swap platform that doesn't rely solely on stablecoins: Levana Perps enables users to open and close positions using native crypto assets, minimizing reliance on potentially unstable stablecoins.

-

Simplify the user experience: Levana Perps prioritizes a minimalistic user interface that appeals to both experienced and first-time traders. With ongoing community support and educational resources, the platform aims to attract and educate new users on the benefits of perpetual swaps.

Levana Perps: Addressing Existing Challenges

-

Centralization: Levana Perps eliminates reliance on off-chain order books or central operators, ensuring decentralization and eliminating single points of failure.

-

Insolvency: The Levana Well-Funded Perps Model guarantees that the platform can always distribute assets to winning positions, eliminating the risk of insolvency.

-

Market Expansion: Levana Perps requires less capital to launch new markets, enabling lower fees and higher liquidity for traders.

-

Contagion Risks: By isolating liquidity pools, Levana Perps allows for the secure launch of new markets without impacting existing ones or exposing liquidity providers to contagion risks.

-

Cascading Liquidations: Levana Perps removes the need for an internal market price, preventing cascading liquidations and enhancing the platform's stability.

-

Flexible Fees: Levana Perps offers traders customizable fee structures based on their specific strategies, enabling a wide range of trading possibilities.

As Levana Perps continues to evolve and expand its offerings, it will undoubtedly pave the way for new strategies and opportunities for traders, liquidity providers, and other participants in the DeFi ecosystem. By prioritizing security, fee reduction, and cross-chain compatibility, Levana Perps is shaping the future of perpetual swap exchanges and solidifying its position as a key player in the world of decentralized finance.

The Levana Foundation has minted a governance token on Osmosis, called the LVN token which will act as a coordination point to bring together and unite the various actors involved with the Levana Protocol. This can include traders, liquidity providers, governors, developers, security experts, analysts and others.

With the support of its community and the ongoing development of its innovative platform, Levana Perps is well-positioned to achieve its goal of becoming the most widely used decentralized perpetual trading platform in the crypto space. As more users discover the benefits and unique features of Levana Perps, it is expected that the platform will continue to grow in popularity and influence, driving further innovation and adoption in the DeFi sector.

Learn more about the system design, high level overview and risks here.

Utility of the LVN Token

With a total supply of 1 Billion, The Levana Foundation has minted its own LVN Governance Token, to empower users and enhance their trading experience on the Levana Perps decentralized exchange.

This section will explore the role of the LVN token, its various premium features within the exchange, and how it can be used for governance over the platform.

What is the LVN Governance Token?

The LVN Governance Token is an integral part of the Levana Decentralized Exchange ecosystem. It is a utility token designed to give users more influence over the exchange, with various use cases and benefits. By holding and utilizing LVN tokens, users can participate in the governance of the Levana platform, access premium services, and even receive discounts on fees.

Potential Future Staking Rewards

Levana follows closely the token economic models of protocols such as dYdX, Kujira, and other which distribute fees from the protocol to staked token holders. This real yield distribution is an effective way to align protocol health from all members of the community. Levana's fee structure is designed in such a way to enable this type of staking rewards, should a future DAO move in this direction.

Access to Premium Features of Levana Perps

Future versions of Levana Perps may include premium features. Access to premium features may be via membership cards. Levana intends to mint 8888 NFT membership cards to enhance loyalty and foster a strong community. LVN holders may be able to earn, rent, or purchase membership cards from NFT holders via the LVN token.

As a premium member, you may gain access to a range of premium features within the Levana Decentralized Exchange. These could include:

-

Fee Discounts: When you use the LVN token in conjunction with Levana NFT membership cards, you can receive significant discounts on trading fees, allowing for more cost-effective transactions.

-

Priority Access: Membership may grant you priority access to new features, products, and services offered by the Levana Decentralized Exchange, ensuring you stay ahead of the curve.

-

Exclusive Airdrops: Members may be eligible for exclusive airdrops and promotional events, receiving additional tokens and rewards.

Governance with LVN Tokens

In addition to the premium features and utility mentioned above, LVN tokens also serve a crucial role in the governance of the Levana Decentralized Exchange. By holding and staking LVN tokens, users can participate in the decision-making process for the platform. This includes:

-

Voting on Proposals: Users can vote on various proposals that will shape the future of the Levana Decentralized Exchange, such as updates to the platform, tokenomics, and more.

-

Submitting Proposals: LVN token holders can submit their own proposals for consideration, driving innovation and improvements within the Levana ecosystem.

-

Delegating Voting Power: If you prefer not to participate directly in governance, you may be able to delegate your voting power to other trusted users, ensuring your voice is still heard.

The LVN Governance Token plays a vital role in the Levana Decentralized Exchange, providing utility, premium features, and governance capabilities for users. As a holder of LVN tokens, you can participate in the growth and development of the Levana ecosystem, access exclusive benefits, and ultimately have a more enriched trading experience.

Attack Vectors Associated with Complete Decentralized Governance too early in the life of a protocol

Decentralized governance offers numerous benefits, such as increased transparency, enhanced community engagement, and reduced single points of failure. However, introducing complete decentralized governance too early in the life of a protocol can expose the platform to various attack vectors, including:

Sybil attacks

In a Sybil attack, a single entity creates multiple fake accounts to manipulate the voting process. Introducing decentralized governance too early, before a diverse token holder base has been established, increases the risk of a Sybil attack.

51% attacks

In this scenario, a malicious actor gains control of more than 50% of the voting power, allowing them to push through proposals that are detrimental to the platform. Early decentralized governance may not have enough active voters or a diverse distribution of tokens to prevent such attacks.

Proposal spamming

With the ability for anyone to create proposals, malicious actors could spam the platform with numerous frivolous or harmful proposals, overwhelming the community and disrupting the governance process.

Low-quality proposals

In the early stages of a protocol, the community may lack the necessary knowledge and experience to make informed decisions. This could lead to the approval of low-quality proposals that could harm the platform.

Governance apathy

If decentralized governance is introduced too early, users may not yet have a strong incentive to participate actively in the governance process, leading to low voter turnout and increased vulnerability to attacks.

A Solution: Gradual evolution of Decentralized Governance

A gradual transition from centralized governance by a foundation to decentralized governance by the community is crucial for the long-term success of a crypto decentralized exchange. This process helps to ensure that the platform is protected from potential attack vectors and that the community has the necessary knowledge and experience to make informed decisions. By following the outlined steps, Levana hopes to successfully navigate the path towards full decentralization while maintaining its integrity and fostering a thriving ecosystem.

Evolution of Governance

Transition from the Levana Foundation to the Levana DAO

In this section, we will explore how a gradual transition from centralized governance by a foundation to decentralized governance by the community can work in practice, the associated attack vectors, and the steps to creating decentralized governance.

The path to achieving decentralized oversight and governance is not straightforward, and may require significant changes along the way. The following represents a potential path:

Token Distribution

The first step in creating decentralized governance is the token distribution. Levana intends to issue its native governance tokens through various means, such as lock drops, airdrops, liquidity mining, and yield farming. The distribution of these tokens is crucial, as it lays the groundwork for future decentralized governance by ensuring a broad and diverse token holder base. This diversity helps prevent centralization and ensures that a wide range of stakeholders can participate in the decision-making process.

Collecting Significant Interest for Governance through a DAO via Staking

The next step is to collect significant interest for governance through a decentralized autonomous organization (DAO) via staking. Token holders can stake their tokens in the DAO, which represents their commitment to the platform and its governance. The more tokens a user stakes, the more significant their voting power in the governance process. Staking creates an incentive for users to actively participate in governance, as they have a vested interest in the platform's success.

Non-Binding Voting

As the platform matures, non-binding voting is introduced. This means that the results of the votes are not binding and serve only as a signal for the foundation. Eventually, this non-binding voting transitions to on-chain votable upgrades and protocol changes, fee management, and other critical aspects of the platform.

Limited Scope of Proposals, Which Becomes Broader Over Time

Initially, the scope of proposals is limited to essential aspects of the platform, such as the introduction of new markets, emission schedules and fee management. As the platform matures and the community becomes more experienced in governance, the scope of proposals becomes broader, encompassing a wider range of issues and decision-making power.

Any Account Can Create Proposals but with a High Submission Fee

As the platform moves towards full decentralization, any account can create proposals, provided they pay a high submission fee. This fee acts as a barrier to entry, ensuring that only those who are serious about their proposals and have a vested interest in the platform's success will submit them.

Full-On Decentralized Governance

Eventually, the platform reaches full-on decentralized governance, where the community collectively makes decisions on all aspects of the platform. This stage represents the complete transition from centralized governance by a foundation to decentralized governance by the community.

Potential Methods of using governance to improve the Levana Perps platform

25% of fees (this may change before launch, or after launch) earned by the platform from traders will be collected in the Protocol treasury, While the remaining 75% of fees are distributed to market participants such as liquidity providers and traders. This treasury will be controlled initially by the Foundation and used to cover operational expenses of the development and maintenance of the Protocol, and over time, by the community of token holders. By leveraging these funds, the Levana Perps protocol can strengthen its position within the decentralized finance (DeFi) ecosystem, grow its user base.

The protocol will launch with no predetermined usage, allocation, or mandate for fees collected in the Protocol treasury.

Funding Community Proposals and Ecosystem Development

LVN token holders can vote to allocate a portion of the treasury funds to community proposals aimed at improving the platform, developing new features, and expanding the ecosystem. By involving the community in decision-making, this approach fosters innovation and ensures that the protocol remains relevant and competitive in the rapidly evolving DeFi landscape. Moreover, a robust and innovative platform is more likely to attract new users, driving increased trading volumes and, consequently, higher fees, leading to greater real yield for token holders.

Liquidity Mining Programs and Trader Incentive Programs

To further increase the platform's user base, a portion of the treasury funds can be allocated to incentivize trading and liquidity mining programs. By offering LVN tokens as rewards for trading or providing liquidity to the platform, Levana Perps can attract more users and increase trading volumes. A larger user base and higher trading volumes translate to higher revenues and a more extensive treasury.

Strategic Partnerships and Integrations

The DeFi ecosystem thrives on interoperability and collaboration. To strengthen Levana Perps' position in the market, a portion of the treasury funds can be used to form strategic partnerships and integrations with other DeFi projects, wallets, and infrastructure providers. These collaborations can bring new users to the platform, increasing trading volumes and fees, ultimately benefiting LVN token holders.

Token Categories, Vesting, unlocks and Emissions

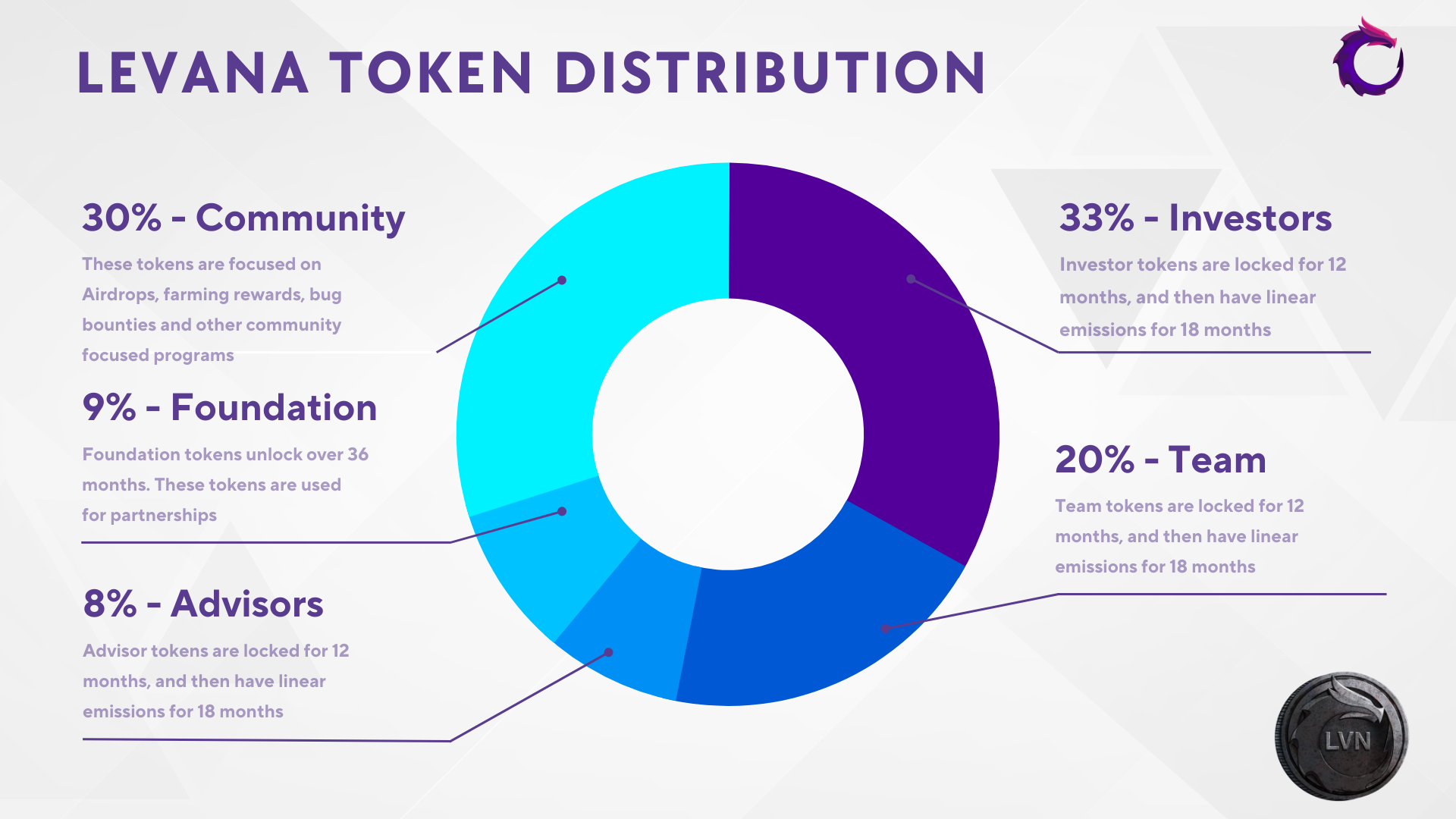

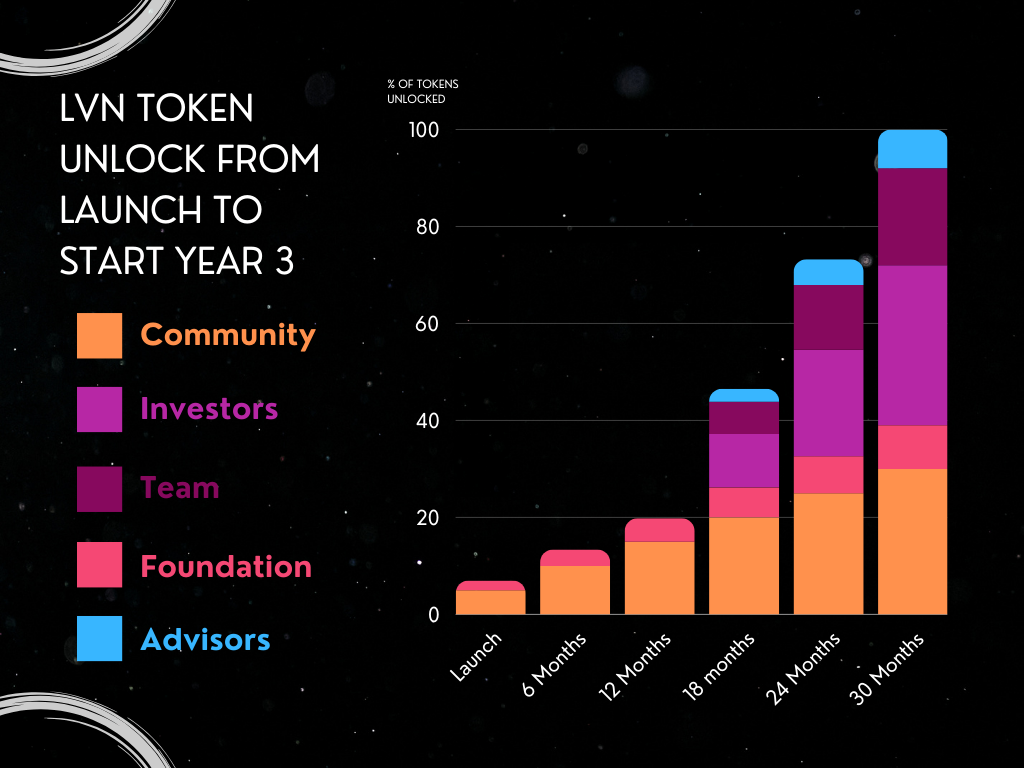

In total, the LVN token has a supply of 1 billion tokens, which are distributed among various categories. These categories include the Community pool, Foundation, Advisors, Team, and Investors.

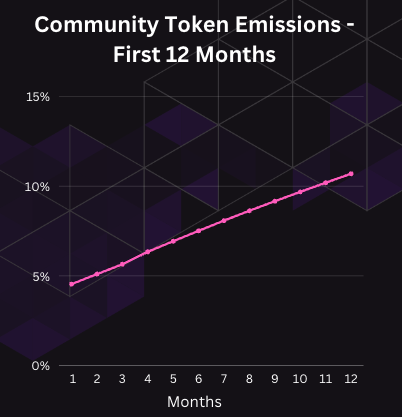

The Community pool consists of 30% of the total token supply, with an initial allocation of 5% unlocked at launch.

The remaining tokens from the Community pool have a linear vesting schedule, with 0.83% of the tokens unlocking monthly over 30 months. This incentivizes community members to hold onto their tokens and participate in the governance of the network over an extended period.

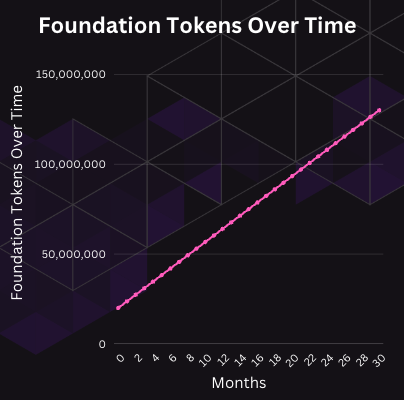

The Foundation receives 9% of the total token supply, with 2% of the tokens initially unlocked. The remaining tokens vest over 30 months, with 0.23% of the tokens vesting each month. This gradual release ensures that the Foundation has a long-term interest in the success of the network and promotes responsible token distribution.

Advisors/Partners and Team members receive 8% and 20% of the total token supply, respectively, with a one-year lock-up period. After the lock-up period, the tokens vest linearly over 18 months. This structure ensures that advisors and team members have a long-term commitment to the project and that their incentives are aligned with the success of the network.

Finally, investors receive 33% of the total token supply, with a one-year lock-up period. After the lock-up period, the tokens vest linearly over 18 months. This structure aligns the interests of investors with the long-term success of the network.

Overall, the LVN token distribution and emission schedule are designed to incentivize long-term participation and responsible token distribution. This structure ensures that all stakeholders have a vested interest in the success of the network and promotes a healthy and sustainable ecosystem.

A spreadsheet that outlines the vesting, emission rewards and others can be viewed here.

Impact of Vesting

Vesting tokens will be eligible for voting, but will not be eligible for earning rewards. This ensures that those in the community who are actively participating in farming will receive the majority of the rewards of the protocol.

The LVN token and the Levana DAO

The LVN token is the heart, soul and brain of the Levana DAO. While the platform will initially launch via a centralized foundation, the goal of the protocol is to become a community owned DAO which oversees all aspects of the protocol's future. This decentralized decision-making process promotes innovation and fosters a strong sense of community ownership.

There are a number of ways in which the LVN token can be utilized to influence the evolution of the Levana Protocol. The following illustrates a few practical areas of governance which will be introduced to the DAO over the transition period from foundation to community control.

Protocol Upgrades and Feature Development

LVN token holders may have the ability to propose and vote on protocol upgrades and new feature developments. By using their governance tokens, users may be able to influence the direction of the platform, ensuring that it remains competitive and meets the evolving needs of its user base.

Fee Structure and Distribution

A key aspect of any decentralized exchange is its fee structure. With LVN tokens, holders can participate in the decision-making process related to the fees charged by the platform. They can propose and vote on changes to the existing fee structure, ensuring that it remains fair, competitive, and profitable. Additionally, token holders can influence the distribution of collected fees, determining how these funds are allocated to create value for the Levana ecosystem and its participants.

Treasury Management

The Levana treasury, which collects 25% of the fees earned by the platform, will be managed by LVN token holders through the Levana DAO after a transitionary period from the Levana Foundation. DAO members will be able to propose and vote on how the treasury funds are utilized, allocating resources to various initiatives such as token buybacks, staking rewards, community proposals, liquidity mining programs, and strategic partnerships. Through active participation in treasury management, LVN token holders can drive the growth and long-term value of the Levana platform.

Community Proposals and Ecosystem Development

As part of the governance process, LVN token holders will be able to submit community proposals aimed at improving the platform and expanding its ecosystem. By voting on these proposals, users will be able to help shape the direction of Levana, ensuring that it remains relevant and competitive in the rapidly evolving DeFi landscape. Engaging the community in this manner fosters innovation, collaboration, and a sense of ownership.

Risk Management and Dispute Resolution

Decentralized platforms like Levana require robust risk management and dispute resolution mechanisms. LVN token holders can participate in the governance of these aspects, proposing and voting on changes to risk parameters, margin requirements, and other key elements related to platform stability and security. Additionally, users can contribute to the resolution of disputes by voting on proposed solutions or offering alternative approaches.

LVN governance tokens play a crucial role in shaping the future of the Levana decentralized exchange. By actively participating in the governance process, token holders may influence various aspects of the platform, from protocol upgrades and fee structures to treasury management and risk management. This decentralized approach empowers users, fostering a strong sense of community ownership and driving the continuous evolution of the Levana ecosystem.

Fees within the Levana perps platform

Trading fees

- Made up of two components:

- Percentage of notional size (your leverage)

- Percentage of counter collateral (how much you borrow, ie Max Gains)

- Taken on every position open and any update which increases either

notional size or counter collateral

- Decreasing these values does not result in any fees incurred

- No trading fees for close

- Current defaults:

- 0.05% of notional size

- 0.05% of counter collateral

- Example

- Trader opens a position with

- Deposit collateral: 1,000 USDC

- Leverage: 30x

- Max gains percentage: 300%

- Notional size in collateral asset: 1,000 USDC * 30 = 30,000 USDC

- Counter collateral: 1,000 USDC * 300% = 3,000 USDC

- Notional size component: 30,000 USDC * 0.05% = 15 USDC

- Counter collateral component: 3,000 USDC * 0.05% = 1.5 USDC

- Total trading fees: 16.5 USDC

- Trader opens a position with

Delta neutrality fee

- Depends on balance of protocol between longs and shorts

- Paid or received whenever the notional size changes: open, update, and close

- As protocol remains neutral, fees are very low

- Sensitivity is chosen based on spot liquidity, not Levana Perps liquidity, making fees small for markets with much more spot liquidity than Levana liquidity

- When protocol is out of balance:

- Progressively larger amount paid by trader for moving further away from balance

- Trader receives incoming payment for moving protocol closer to balance

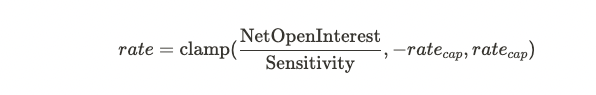

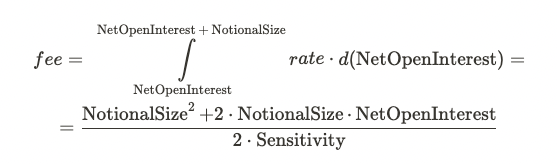

- Instant delta neutrality fee rate on notional size of the position is:

- Rate cap for liquid markets will be around 0.5% and larger for less liquid assets.

- If the caps were not hit for the trade, the fee amount is

- Example

- Protocol is overly short, hitting the cap of 0.5%

- Open a long with 0.75 ATOM collateral at 10x leverage

- Resulting delta neutrality fee: trader receives approximately 0.0375 * (1 - tax) = 0.026 ATOM

Funding fee payments

- Separate rates for longs and shorts to ensure balance of paid and received fees

- Accrued over time while a position is open

- Fees are taken during liquifunding (fee assessment, funding

payments, and liquidation margin update). Liquifunding occurs at:

- 24 hour intervals

- On each position update

- When closing a position (manually or through liquidation/take profit)

- Either an outgoing fee (when position is on the popular side) or incoming (when position is unpopular)

- Fees are larger in magnitude the further out of balance the protocol is

Borrow fee

- Like funding fee payments: accrued linearly, fees taken during liquifunding

- Dynamic borrow fee rate based on supply and demand

- Target utilization of liquidity = 90%

- If actual utilization is below 90%: decrease borrow fee rate

- If actual utilization is above 90%: increase borrow fee rate

- Percentage of counter collateral, which is determined by deposit collateral + max gains percentage

Crank fee

- Cranks are used for scheduling activities (like liquifunding)

- Crank fees are used to offset the cost to the protocol for executing these activities

- Crank fee is paid by the position

- Crank fee is set at 0.01 USD (converted to collateral asset at time of payment)

- Crank fees are paid into the crank fund

Recipients of fees

Trade and borrow fees

- Split between protocol and liquidity providers

- A protocol tax component on fees (currently: 25% may change before launch)

- Remainder is split between LP and xLP token holders

- xLP tokens receive a multiplier of rewards versus LP to account for time locking

- Minimum multiplier: 1. Maximum multiplier: 2.

- Actual multiplier: linear interpolation between min and max based

on xLP percentage of the pool

- More xLP means lower multiplier, less incentive to lock up

- Less xLP raises the multiplier, incentivizing further lock up

Delta neutrality fee

- 25% of delta neutrality payments into the system are taken by the Protocol

(initially managed by the Foundation) and liquidity providers

- Split using same breakdown as trade and borrow fees

- Disincentivizes price manipulation attacks on the protocol

- Remaining 75% is taken by traders opening unpopular positions to help balance the protocol

Crank fee

- Crank reward is significantly lower than crank fee (0.001 USD instead of 0.01 USD)

- This accounts for protocol-level cranks that need to be incentivized as well (such as price updates)

- Cranks are paid on an as-available basis: exchange rates and extra protocol cranks can deplete the pool early

- Anyone can perform a crank to try to get a crank reward

Fee Summary

The fee structure on Levana Perps is designed to create a profitable network with all market participants performing their required roles with the assumption that each are rational, selfish actors.

75% of the fees collected by the protocol from traders will go to LP real yield rewards. 25% of the fees go to the Protocol (initially managed by the Foundation, later managed by the DAO)

An unofficial fee calculator can be found here. This calculator may be used to better understand and predict fees generated by the platform.

Real Yield vs Protocol Emissions

GMX and similar protocols have gained significant attention in the world of decentralized finance (DeFi) as platforms that allow liquidity providers (LPs) to lend capital to leverage traders and collect fees in the form of real yield.

In this article, we will explore the concept of real yield, the various rewards paid to LPs on the Levana Perps platform, and the risks associated with providing capital to the exchange. We will also discuss the different ways to provide liquidity and how to calculate the different types of rewards.

What is Real Yield?

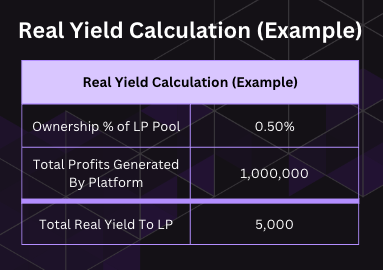

Real yield refers to the process of taking the funds earned by a trading platform and paying out liquidity providers from the profits generated via the use of their provided funds. On the Levana Protocol, real yield is calculated by taking the ownership percentage of the liquidity provided to the pool and comparing it to the payout. See example below for real yield calculation (assumes Protocol Tax is zero)

The platform distributes real yield to LPs while also providing the potential to receive yield via Levana's governance token, LVN.

Rewards for Liquidity Providers

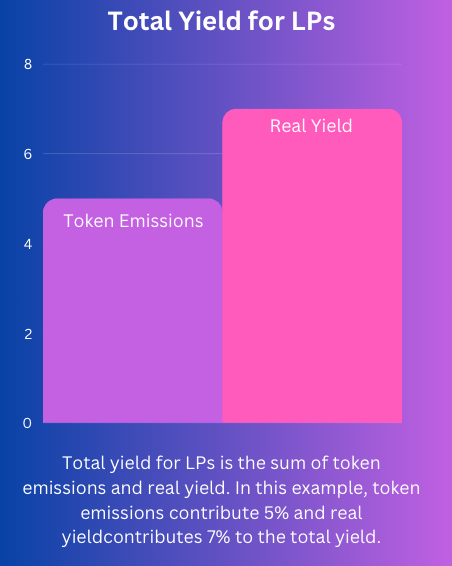

Liquidity providers are paid in two ways: Real Yield and LVN token emissions.

Of the real yield collected by the protocol, 75% of the fees are paid out to liquidity providers, with the remaining 25% allocated to the Protocl (later the DAO) or foundation. These numbers may change in the future as the DAO gains control over the configuration.

Ways to Provide Liquidity

There are two primary ways for LPs to contribute capital to the Levana Perps platform:

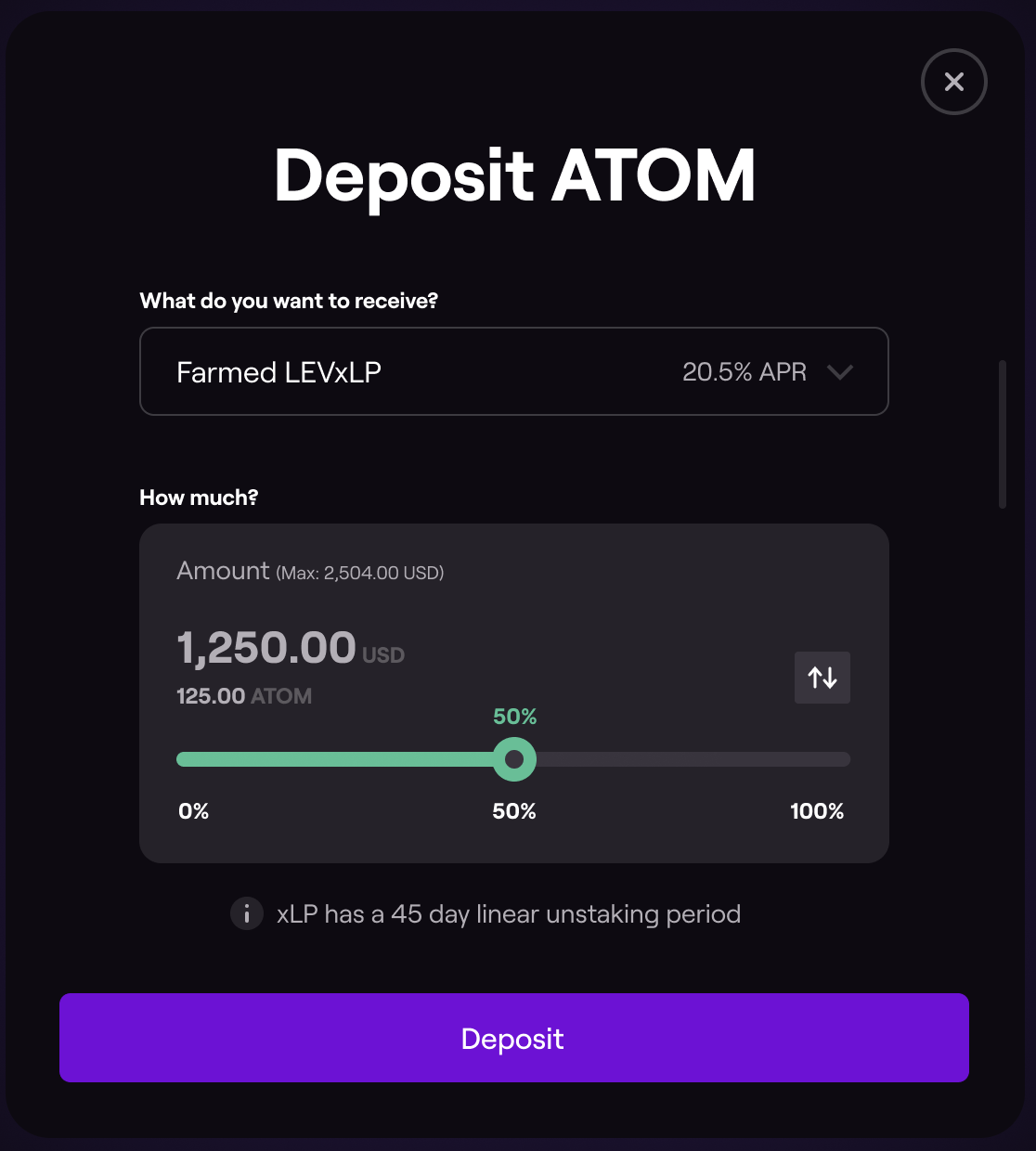

- LP Tokens: When users contribute capital to the LP pool, they receive LP tokens in return. These tokens have no lock-up period and earn about one-third of the rewards paid to liquidity providers.

- xLP Tokens: When users contribute capital to the xLP pool, they receive xLP tokens in return. These tokens have a 45-day unbonding period and earn roughly two-thirds of the rewards paid to liquidity providers. During the unbonding period, xLP tokens function like regular LP tokens, earning roughly one-third of the real yield paid to LPs.

The ratio of rewards between LP and xLP holders is estimated to be 1/3 and 2/3 respectively, but this may shift over time based on the popularity of each pool.

In addition to real yield, xLP tokens can be staked in a staking contract to earn LVN token emissions. This can result in significantly higher APRs compared to holding LP tokens with no lock-up.

You can read more about how to provide liquidity to Levana Perps here.

Breaking Down Total Yield

Total yield for LPs can be broken down into two parts: token emissions and real yield. Token emissions refer to the distribution of LVN tokens, while real yield is the portion of the profits generated from the trading platform that is paid to liquidity providers. Calculating total yield requires adding the APRs from both token emissions and real yield.

Risks Associated with Providing Capital

It's important to note that providing liquidity to the platform contains significant risk:

Please read our disclaimer and terms of service. In summary the two largest risks for providing liquidity are as follows:

Liquidity providers face two main risks when contributing capital to the Levana Perps platform:

- Counterparty Risk: LPs act as counter traders to leverage traders, meaning they may be exposed to potential losses if the leverage traders' positions go against them.

- Platform Risk: This refers to the risk associated with losses due to potential exploits, such as smart contract vulnerabilities or other unforeseen events.

Understanding real yield and the various rewards paid to liquidity providers on the Levana Perps platform is essential for anyone considering participating in this exciting DeFi ecosystem. By evaluating the different ways to provide liquidity, the associated risks, and the calculations for rewards, potential LPs can make informed decisions about their involvement in the Levana Protocol.

Farming Emissions

One of the most popular mechanisms for distributing tokens in DeFi is farming. Farming enables users to earn tokens by providing liquidity to the platform. In this section, we will explain how farming works and what actions a user can take to be eligible to receive tokens.

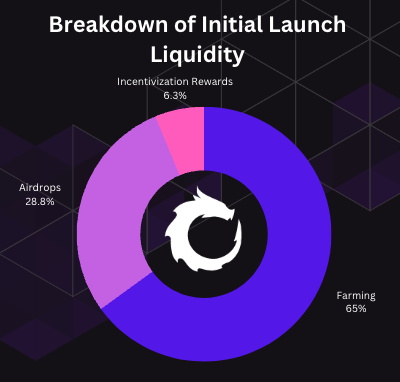

At launch, roughly 40 million LVN tokens will be liquid, with approximately 65% (26 million) of these tokens allocated to farming rewards to the community.

What is farming?

Farming is the process of providing liquidity to a DeFi platform by locking up cryptocurrency in a liquidity pool. In return, users receive rewards in the form of newly minted tokens. The rewards are distributed based on the proportion of liquidity a user provides to the pool. The more liquidity a user provides, the more tokens they receive as a reward.

There are several ways to farm on the Levana Perps platform. The largest farming reward pool on Levana Perps is the 15 million LVN tokens allocated to the lockdrop.

Why farm?

Farming is a popular mechanism for distributing tokens in DeFi. By providing liquidity to the platform, users can earn rewards in the form of newly minted tokens. This aligns interest between the users of the protocol and the long term success of the protocol. There are several ways to farm tokens in DeFi, such as Lockdrop, xLP pools, Osmosis pools, DAO, and trading rewards. Users can participate in farming by locking up their cryptocurrency, contributing to liquidity pools, staking their tokens in DAOs, or opening long or short positions.

Farming on the Osmosis DEX AMM

Osmosis Pools is another way to farm tokens in DeFi. Over 10 million tokens will be used in the first year to incentivize providing liquidity to Osmosis pools for Levana. The LVN<>Osmo pool will include a 1.5 million LVN reward program for adding liquidity to the LVN<>Osmo pool on Osmosis in the first month after the protocol launches.

Farming via DAO staking

While initially no Farming or Staking will be supported These are both popular token economic mechanisms and may be incorporated into Levana at a future date.

The DAO is another farming option that allows users to stake their tokens in a decentralized autonomous organization (DAO) and receive staking rewards. The DAO will have staking rewards of 7 million tokens for LVN holders that stake LVN into the DAO. The first month will have a bonus of 1 million tokens, with the following months emitting 500,000 tokens per month.

Lastly, trading rewards are also a mechanism for earning tokens in DeFi. Up to 6 million tokens are earmarked to pay out trading rewards to traders that open long or short positions in the first month of the protocol's launch. Over the first year, over 23 million tokens will be earmarked for potential use of trader rebates and rewards.

Conclusion

The LVN token serves as the native utility token for the Levana Protocol, which offers various use cases, including participating in liquidity provision, earning rewards and extra features, and governance.

Once acquired, users can utilize their LVN tokens for various activities within the Levana Protocol, such as staking, participating in governance decisions, and earning additional rewards and premium features.

Interacting with experimental software such as the Levana Perpetual exchange, or the various farming elements is extremely risky and may result in a total loss of funds. Please read the complete disclaimers and terms of service before participating in any part of Levana.